Tax Increment Financing (TIF)

What is Tax Increment Financing?

Tax Increment Financing (TIF) is a tool that municipalities use to boost economic development in areas that are blighted or in decline. Here's how it works: Local governments establish a TIF district, thereby setting a base value for the properties within the designated area. The property taxes collected from these properties continue to go to existing taxing bodies, such as school districts, just as they did before the TIF was set up.

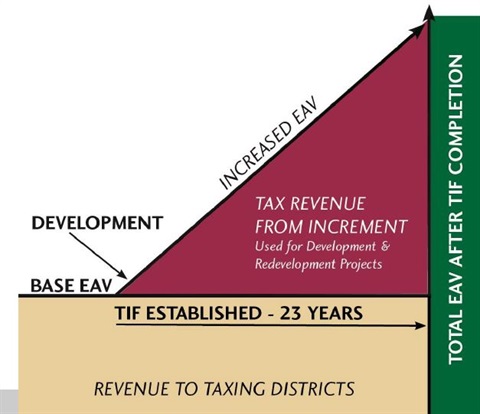

The "tax increment" is the additional property tax revenue that results from an increase in the EAV of properties after the TIF district has been created. The increment (or increase in property taxes above the TIF base) is controlled by the City and can be used to fund public improvements or assist private development within the TIF district. In other words, the additional revenue generated from the rise in property values after the TIF is established is allocated to the municipality to finance development and redevelopment projects within the district. The chart on the right illustrates TIF increment is generated after a TIF district has been created.

How the City can use a TIF to assist in development?

In the event a blighted building or property can not be redevelopment due to extraordinary costs, the City can use the TIF increment to pay for the TIF eligible expenses. Common TIF eligible expenses include redevelopment of obsolete or vacant buildings, demolition and site preparation, clean up of polluted or contaminated areas, providing and updating public infrastructure, rehabilitation of historic properties. In St. Charles, developers or businesses are expected to front the costs of the project and are reimbursed by the City via TIF increment rebates. If funds are available, the City can sometimes reimburse via a grant.

How to Apply

Before applying for financial assistance, applicants must first meet with city staff to review the approval process, discuss their financial request, and outline the project's general details. This pre-meeting does not involve discussing specific incentive terms but provides guidance on how to proceed with the application. To apply, submit an application packet along with a $7,000 fee to cover the City’s legal, administrative, and review costs. This fee is refundable if not fully used, but additional costs for external consultants must be covered by the applicant.

The Part 1: Financial Assistance Application(PDF, 114KB) is a preliminary review that allows staff and the City Council to assess the request and its initial terms, though it does not guarantee approval. Applicants need to show why financial assistance is necessary and provide relevant documentation.

The Part 2: TIF Financial Assistance Application(PDF, 95KB) on the other hand, provides a detailed review of the need for assistance, final terms, and comprehensive documentation, including financial commitments, plans, developer background, and cost estimates. The City Council will use this information to decide whether to approve or deny the request.

Applicants are also required to submit audited financial statements for the past three years (or two years if comparative), interim financial statements for the current year, and a list of all investors with their names, addresses, and ownership interests. If needed, documents may be provided directly to the City’s financial advisor or legal counsel to maintain confidentiality.

Existing TIF Districts

There are currently five active TIF Districts within the City of St. Charles as shown below in the interactive map below. By state statue, the length of each TIF is 23 years. Each TIF district was created in different years, thus expiring in different years.

Expiration date of the active TIFs:

St. Charles Mall TIF #3: 2024

First Street TIF #4: 2025

STC Manufacturing TIF #5: 2028

Downtown TIF# 7: 2037

Pheasant Run TIF #8: 2045

Interactive TIF Map